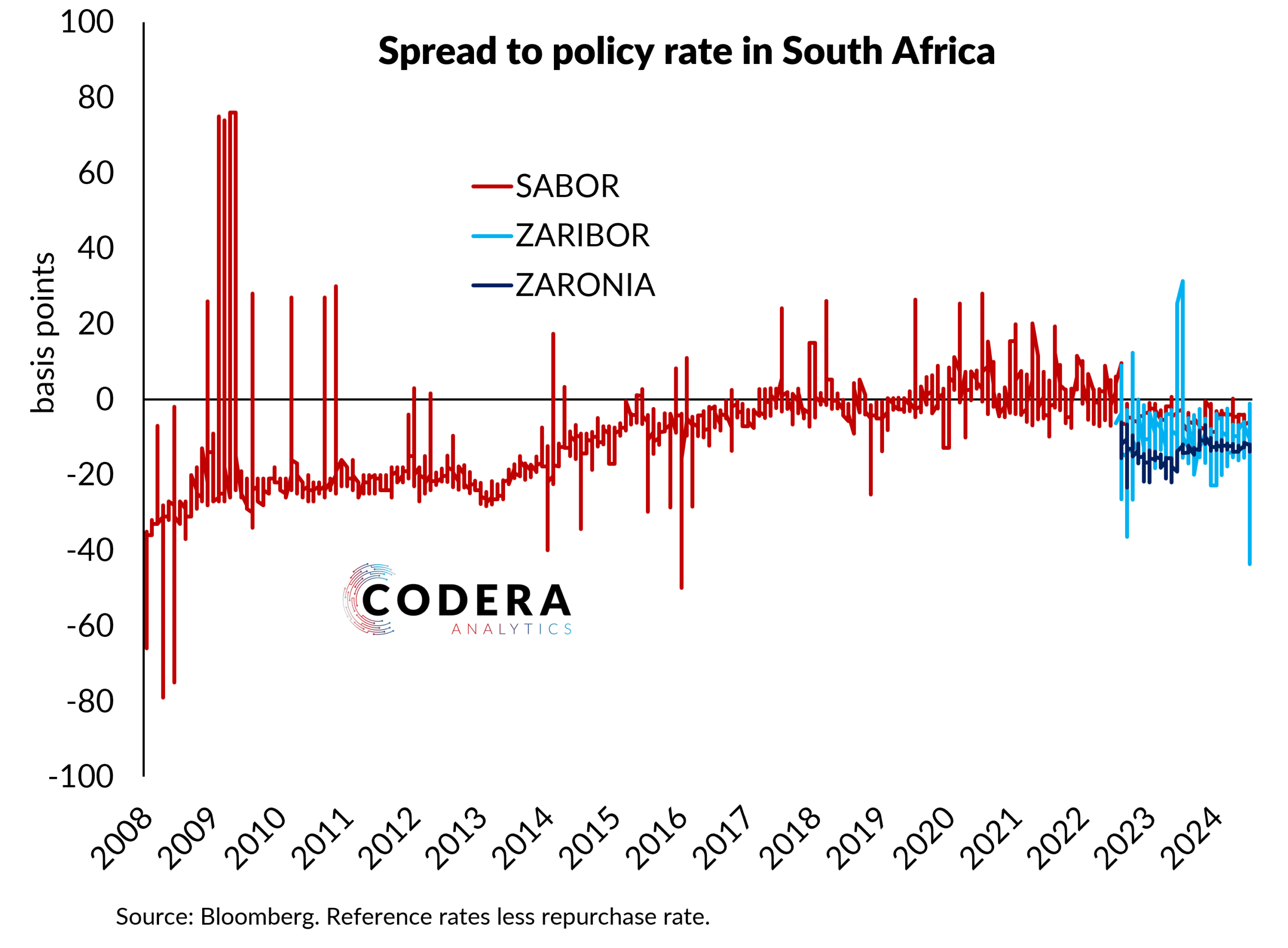

Since the start of their publication, the proposed money market reference rates ZARIBOR (South African Rand Interbank Overnight Rate) and ZARONIA (South African Rand Overnight Index Average) have had large and volatile spreads to the policy rate. Today’s chart shows that the South African Benchmark Overnight Rate (SABOR), the current overnight benchmark rate in South Africa, has also been below the policy rate since the implementation of the new monetary policy implementation regime in June 2022. ZARIBOR and ZARONIA are meant to be more representative of the rates associated with rand overnight wholesale funding obtained by banks and unsecured overnight rates, respectively. However, the observed spikes in these reference rates raise questions around their representativeness of market conditions for particular days. Negative spreads in the case of the new reference rates reflect SARB’s unremunerated cash requirements on banks, and specific aspects of their calculation, such as trimming of very high and very low rate transactions from ZARONIA’s calculation, for example. Since the repo is a secured rate, it is also important that secured benchmark rates are also published to enable monitoring of whether policy changes are being reflected in market conditions. SARB is planning to publish ZASFR, the South African Secured Overnight Financing Rate, a secured overnight benchmark, but has not made it available as yet.