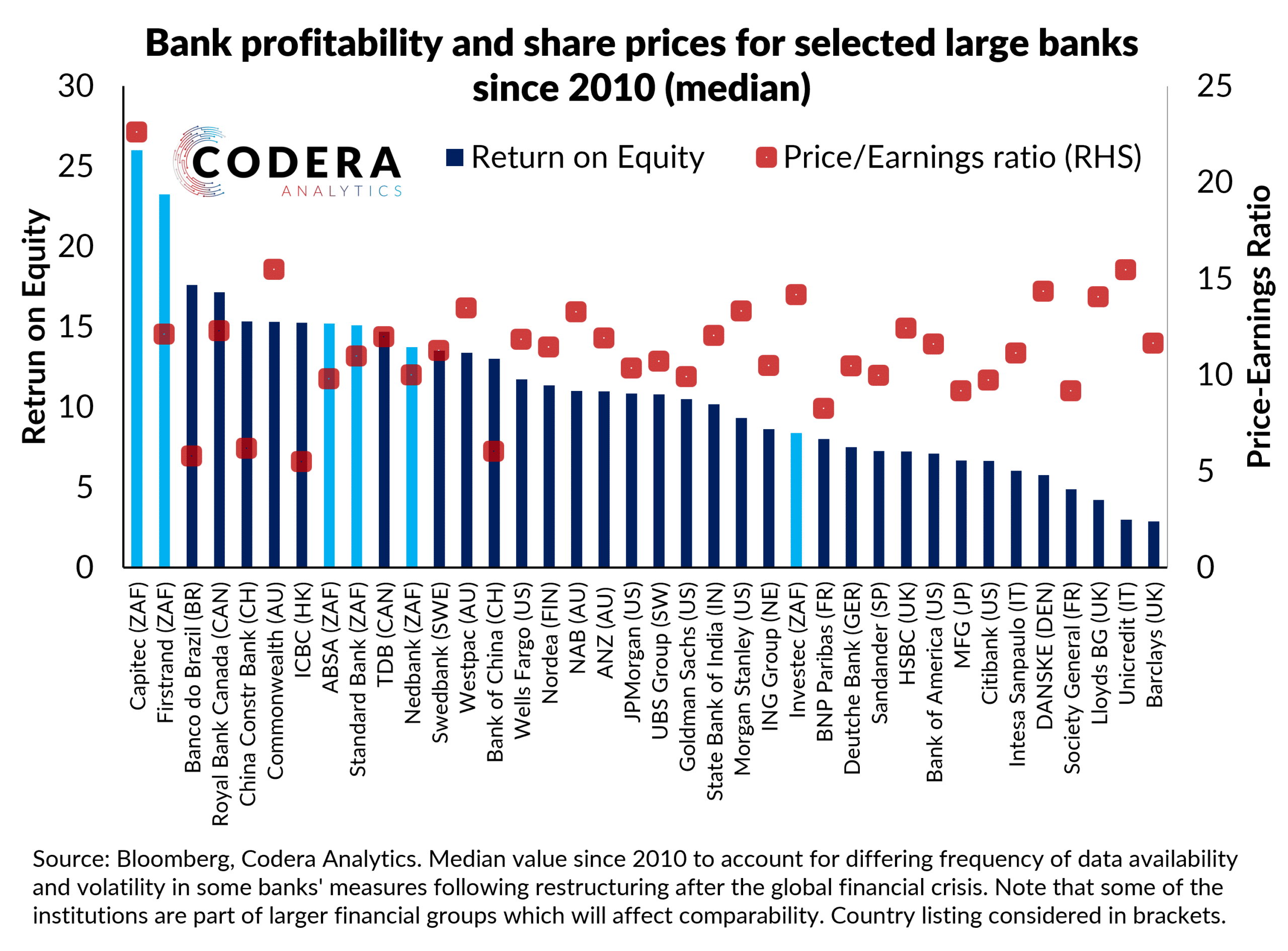

South Africa’s major banks stand out globally among large banks in terms of their return on equity (ROE) ratios. With the exception of First Rand and Investec, South African large banks have traded pretty fairly to their ROEs in comparison to large global banks.

Footnotes

Codera’s banking dashboard makes it easy for analysts to access and analyse hundreds of different measures of banks’ financial position, that in turn indicate bank performance and broader financial stability risk. Get in touch if you would like to subscribe to our banking dashboard.

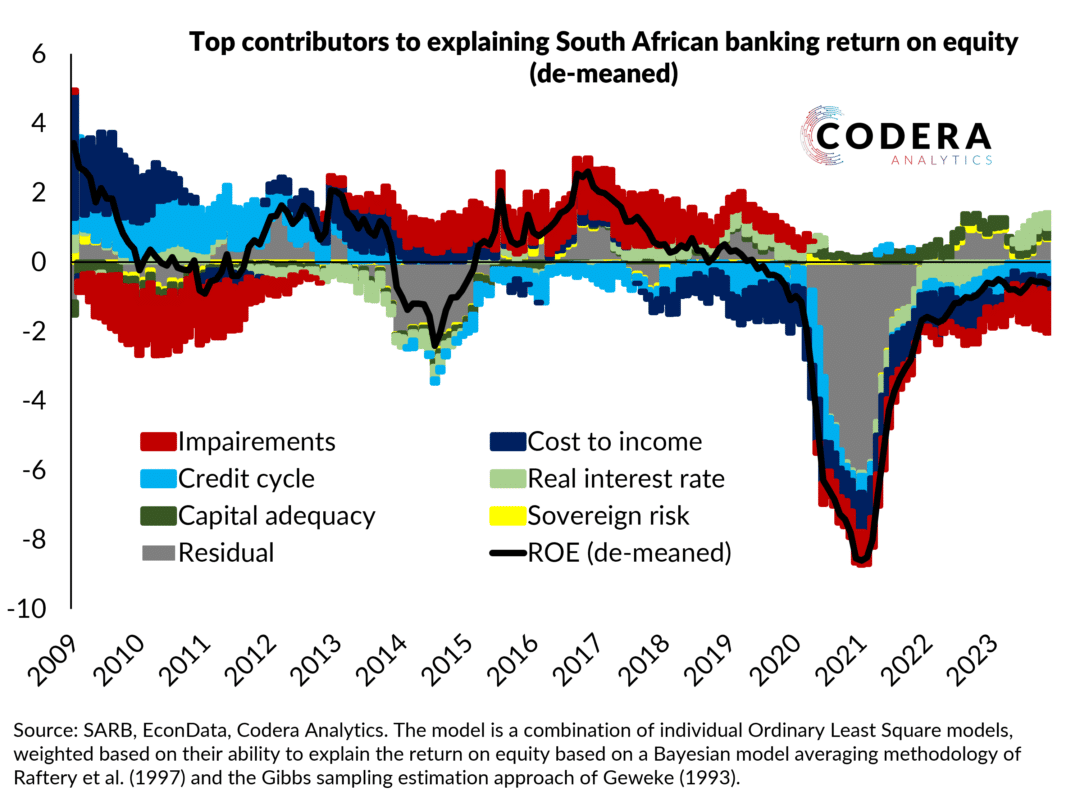

Our bank ROE model suggests that impairments, cost-to-income and the credit cycle have been key drivers of SA bank ROE.