Our paper ‘Risk and Return Spillovers among Developed and Emerging Market Currencies‘ has been published in the Journal of International Financial Markets, Institutions & Money.

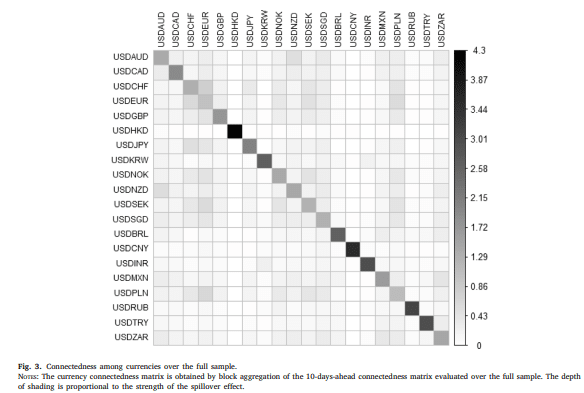

We use intraday data to analyze the network structure of FX returns and risk shocks, and show that developed market currencies are more integrated within the global FX network than emerging market currencies on average and tend to become more dependent on external conditions over time. Spillovers between emerging developed markets and emerging markets evolve more rapidly than spillovers within developed markets and within emerging markets and are a major contributor to overall spillover dynamics.

Our findings suggest that investors rebalancing away from EMs may contribute to the elevated FX connectedness that we observe in times of stress. To the best of our knowledge, ours is the first study to provide statistical evidence on the linkage between bilateral DM/EM spillover activity and the factors that drive capital flows between DMs and EMs and adds to the evidence of a link between FX connectedness and trade policy uncertainty.