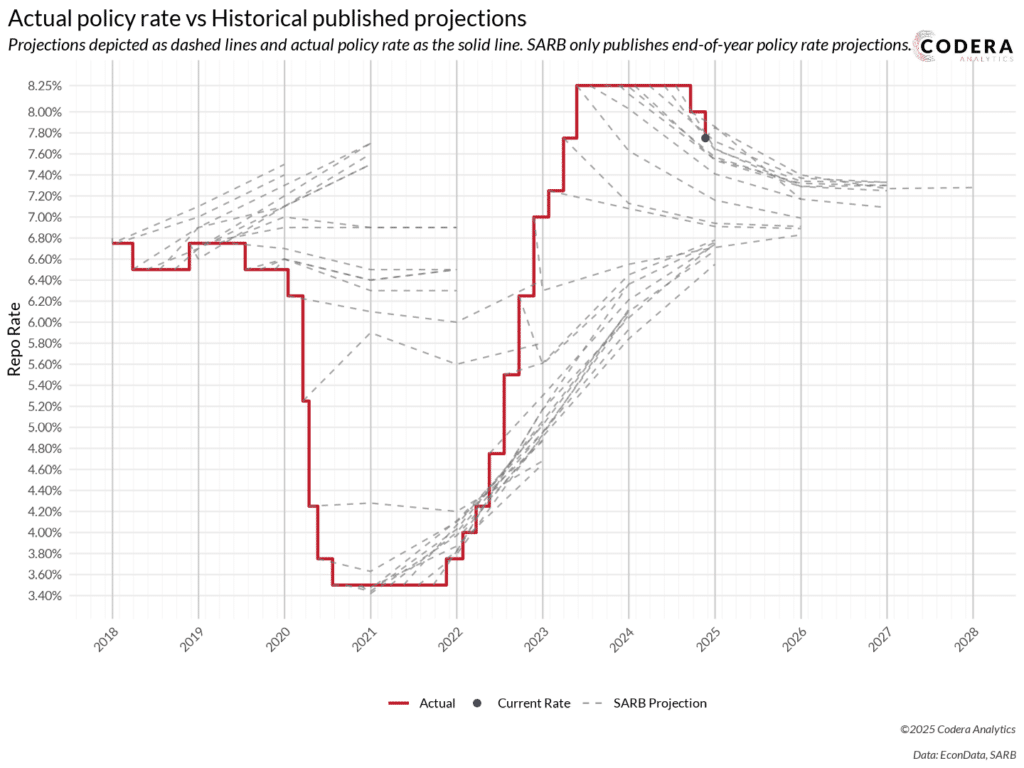

Today’s chart of the day shows that there have been times when SARB policy decisions have diverged from their published policy rate forecasts that accompany a decision. The divergence between policy actions and projections were particularly large during late 2022 and 2023. The COVID-19 pandemic period should be set aside given the unpredictability of the occurrence of the pandemic. However, in the aftermath of the pandemic, the SARB continued to interpret the pandemic as predominantly a demand shock, under-estimating the risk of supply-related inflation pressures in its wake. This meant that the post-pandemic spike in inflation caught SARB by surprise, as they have been slow to revise their judgements about the underlying trends in the economy, for a long time holding on to a view that inflation pressures would be transitory despite growing evidence to the contrary. The SARB’s November projections imply an end of year policy rate for 2025 of 7.4%, suggesting they are assuming one further 25 basis point cut would be broadly consistent with achieving the inflation target over the medium term.

Compiled by Johan Hanekom and Aidan Horn