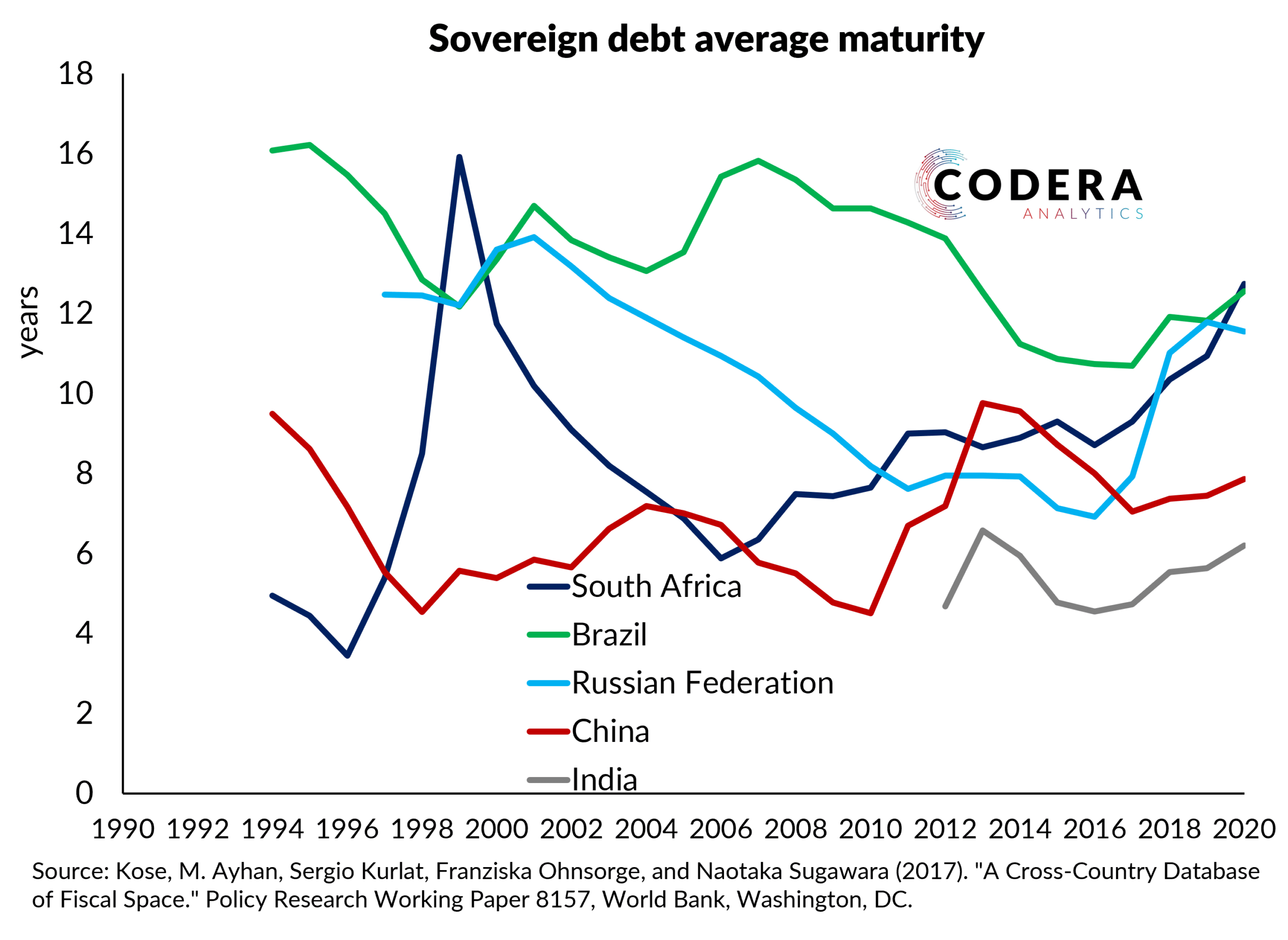

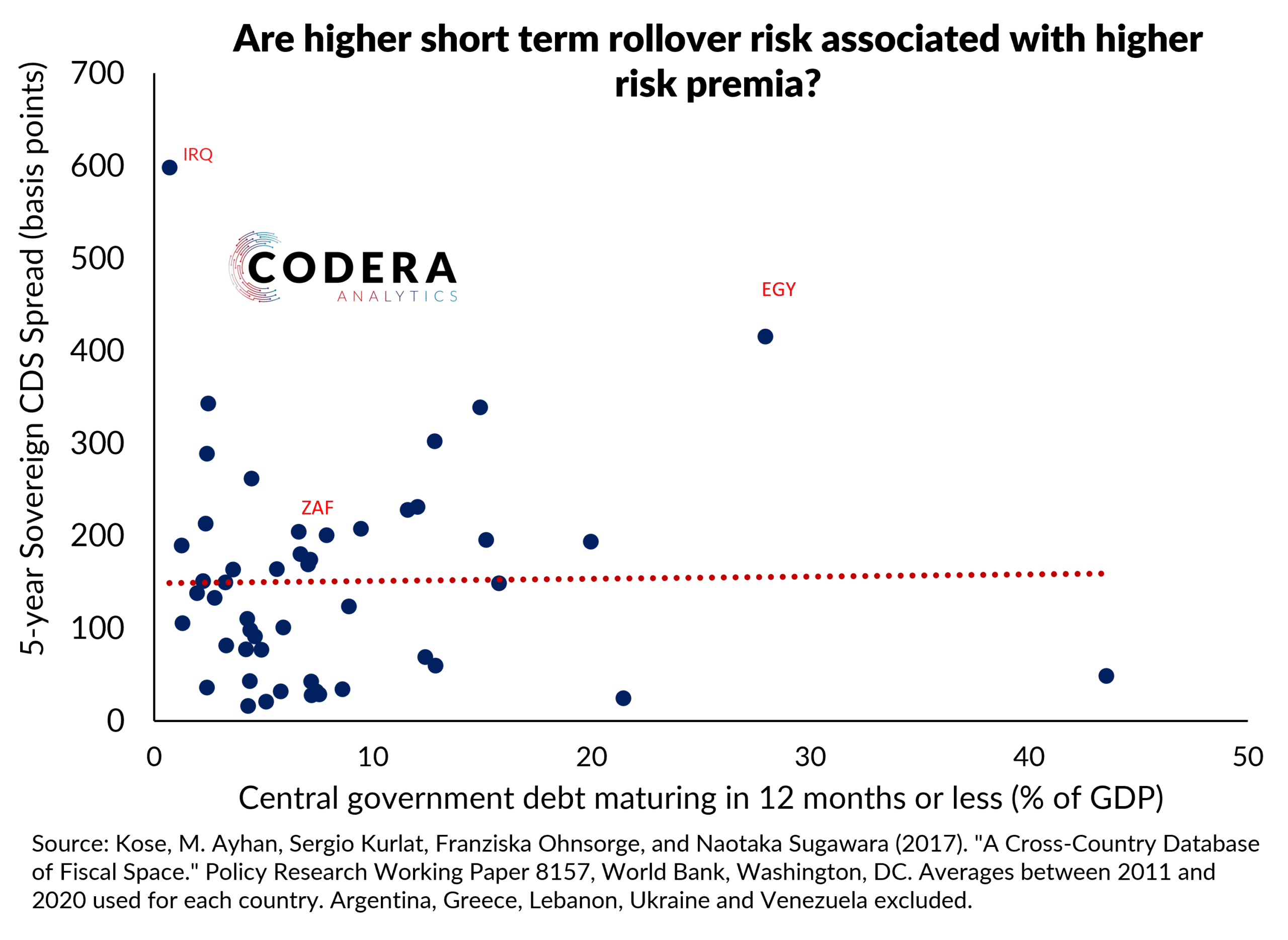

South Africa has extended the average term of its sovereign debt over time, from around 6 years in 2006 to over 12 years in 2020, a level comparable to those of Brazil and Russia. Lengthening the term of borrowing serves to reduce rollover risk, although it implied, after the GFC and a period of historically low short term interest rates, higher funding costs than could have been obtained by funding at shorter maturities. Interestingly, the final two charts in the blog post do not suggest that countries with longer funding structures had systematically lower overall risk premia over the last decade or so.