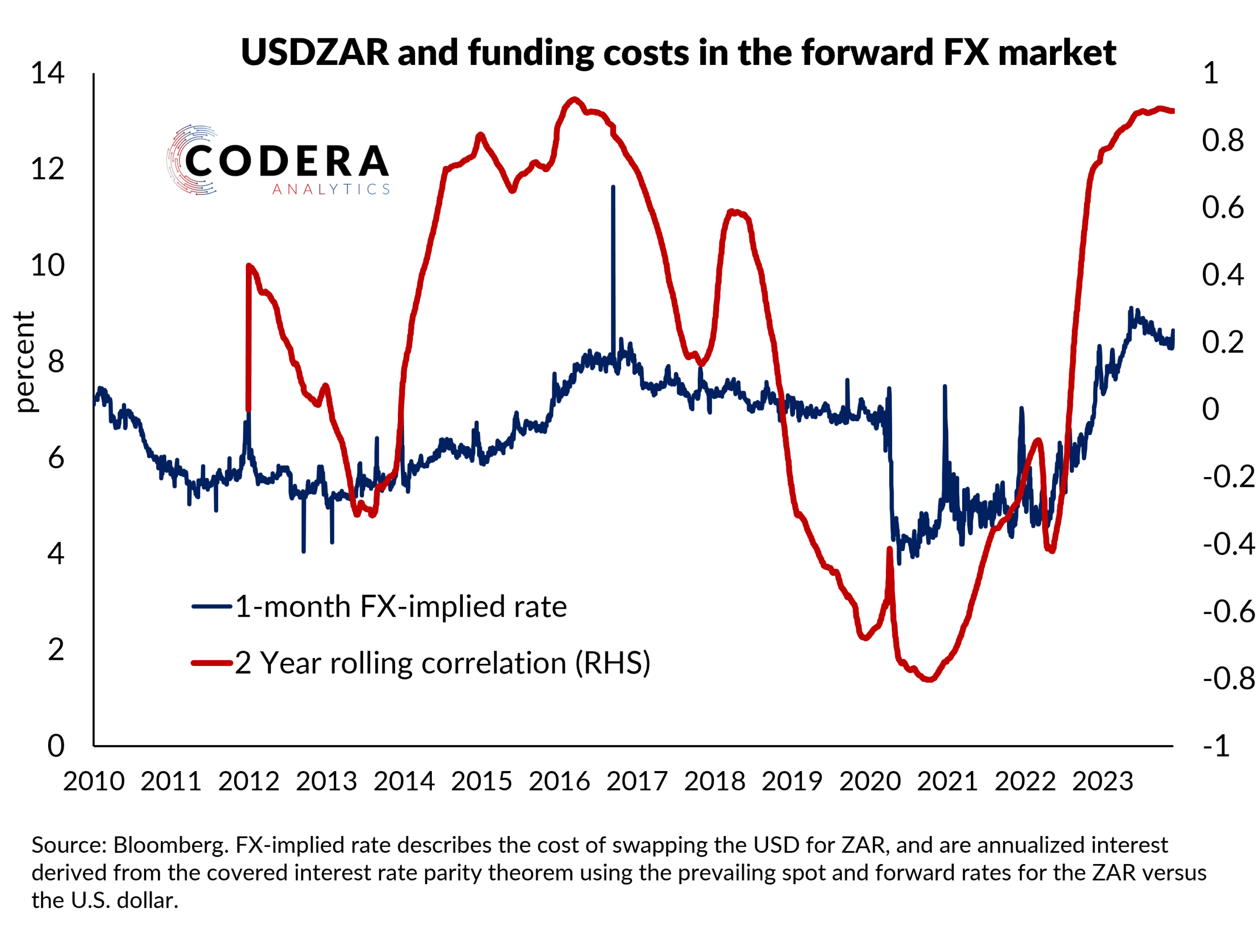

The cost of borrowing USD to fund ZAR investments has converged with the policy rate over recent months. This suggests earlier ZAR liquidity shortages in the forward rate market have been alleviated. This has been accompanied by a strengthening of the correlation between the USDZAR and the FX-implied rate over the course of 2023. This may have reflected changes in market expectations about relative interest rates over the year, and may also have been helped by a shift to a surplus-based monetary policy implementation regime. Although interest rates rose in South Africa and overseas during 2023, the differential between the South African and the US policy rate, for example, has remained relatively stable. But as we showed in an earlier post, the correlation to the USDZAR of interest rates differentials has strengthened. This is particularly interesting, since rand carry returns remain lower than for several emerging market carry currencies and since data from the US Commodity Futures Trading Commission suggest that the market was short the rand between for much of 2023.