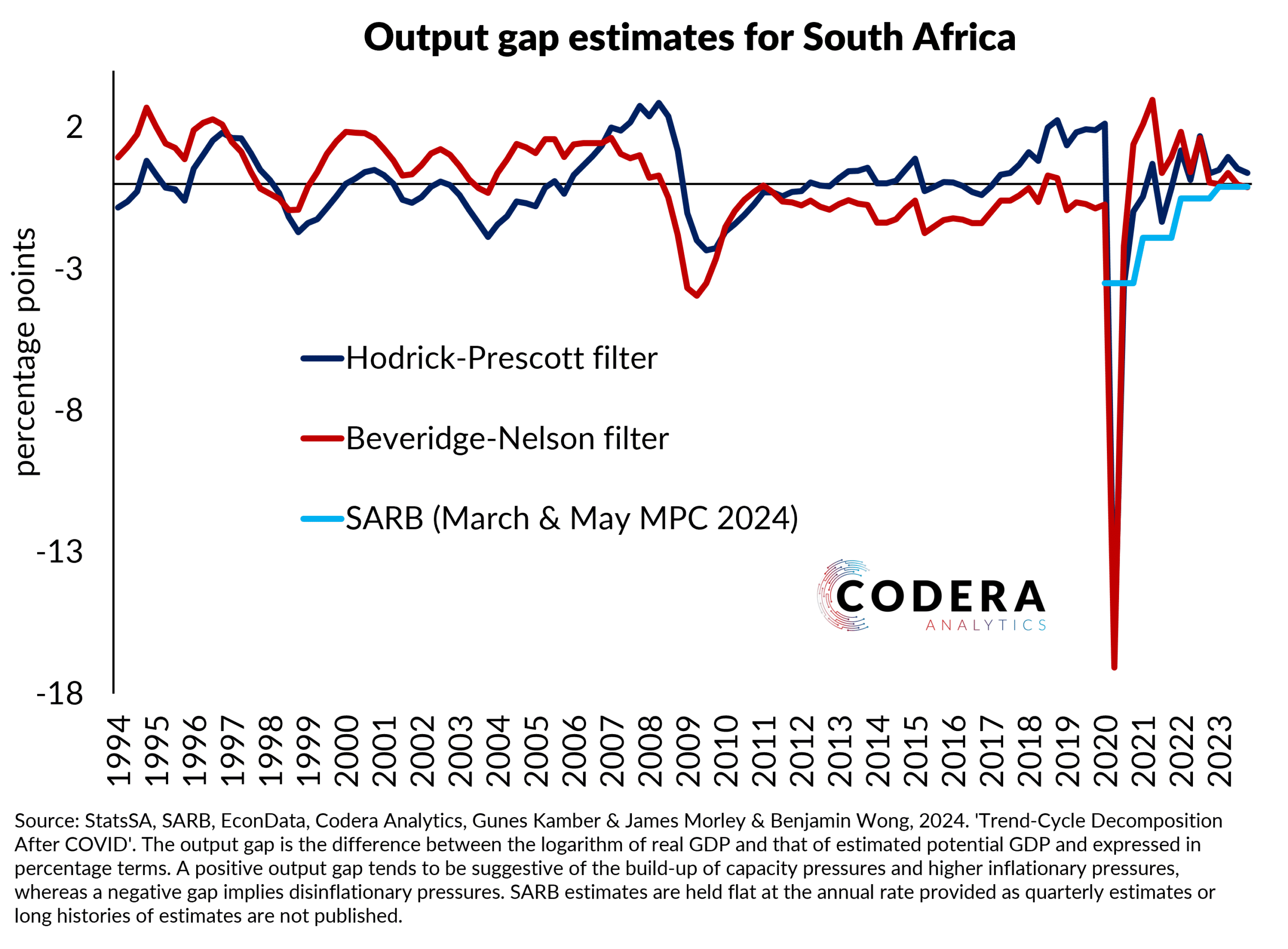

In today’s post we look at what recent GDP outturns imply for the state of the economy and capacity pressures. We estimate statistical filters for estimating the output gap (a measure of economic slack) and they suggest that the output gap is near zero, close to the most recently published SARB assumptions (from the May 2024 MPC). A Beveridge Nelson filter implies a smaller positive output gap before the global financial crisis but a larger post-pandemic gap than a Hodrick-Prescott (HP) filter. Our filters currently suggest that potential growth remains below 1%. The SARB’s recently published assumptions have potential growth at 0.1% for 2023, rising to 1.1% in 2024. Like the SARB, the IMF has progressively lowered its projections of South African potential growth over time.

Footnote

Note that the HP filter is a commonly used statistical approach for output gap estimation. The problem with simple filters such as the HP is that they are not well suited to interpreting the economic impact of the COVID shock. That said, they are a useful benchmark to compare more sophisticated approaches against. For a real-time comparison of the HP filter see this earlier post.