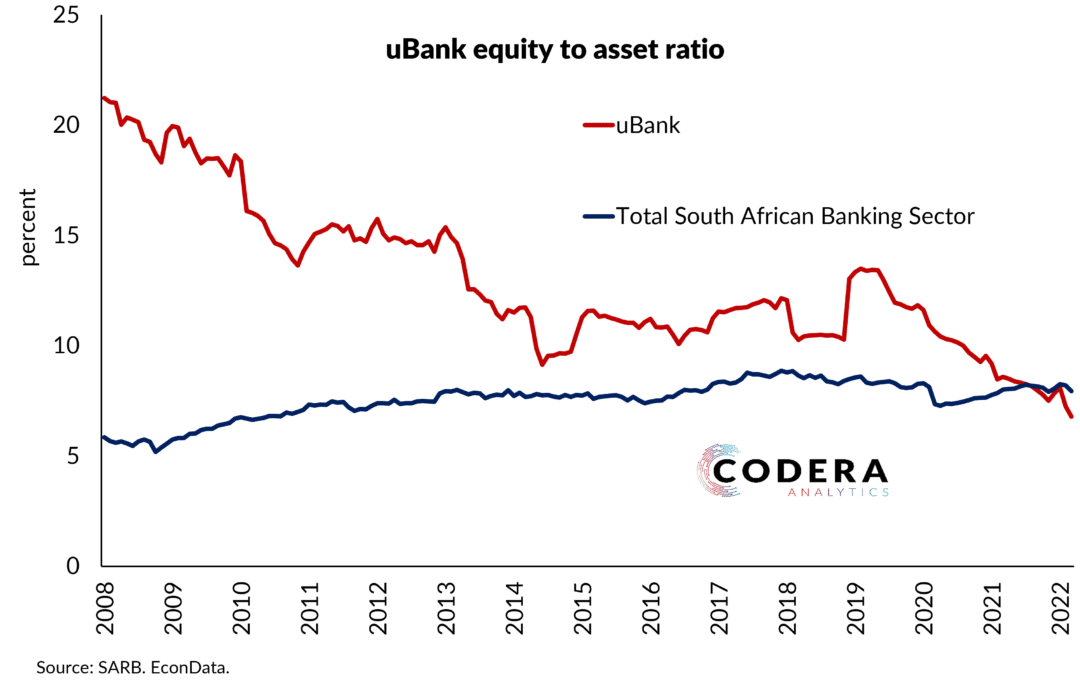

Codera today released a new banking dashboard today. The dashboard will have a free to use trial version during July 2023 and consists of over 300 accounting line items per bank, per month, and additional custom indicators developed by Codera. One of the custom indicators available on the dashboard is the ratio of impairments to total loans for each bank in South Africa, and in total. The ratio of bank loans that are recorded as impaired on bank balance sheets to total loans and advances for the banking sector is slightly down from its post-COVID-19 pandemic peak but is currently still higher than at the peak following the global financial crisis. This suggests that South African households and businesses are still under a lot of financial pressure as they struggle to repay bank debt given tough economic conditions and the increases in interest rates. This is also useful for analysing differences in the types of loans different banks are making and how prudent banks are at positioning themselves to withstand higher expected credit losses. You can sign up for a free trial to the dashboard here: https://app.codera.co.za/banking-dashboard/