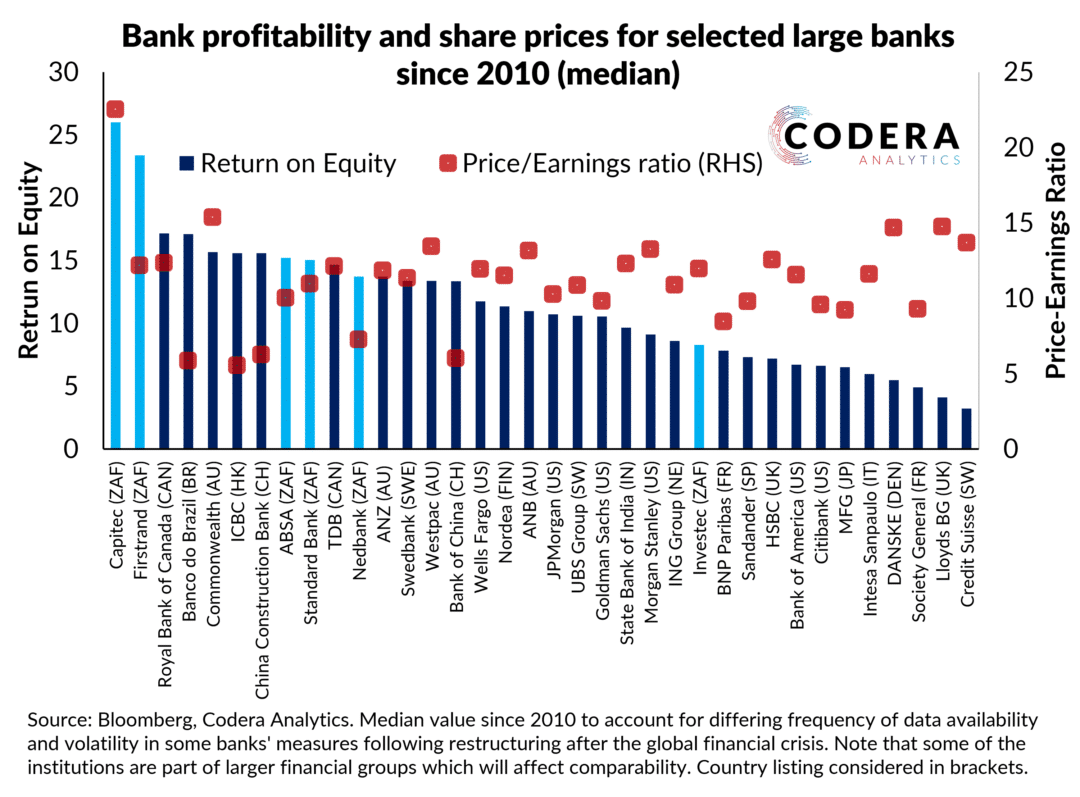

South Africa’s major banks appear very profitable by global standards and stand out among large banks globally in terms of their return on equity (ROE) ratios. Interestingly, across large banks across the world, there appears to be a weak relationship between ROE and price-earnings (PE). There are many possible explanations for this. These include that bank stock prices embed market expectations of the outlook for national economies and financial conditions; that there are differences in how banks provision for bad loans; that banks differ in how they value illiquid assets; that banks differ a lot in how leveraged their assets are; or that inflation differences could affect bank profitability comparability. Future blog posts will provide additional comparisons to assess the contributions from such differences to differences in equity performance.