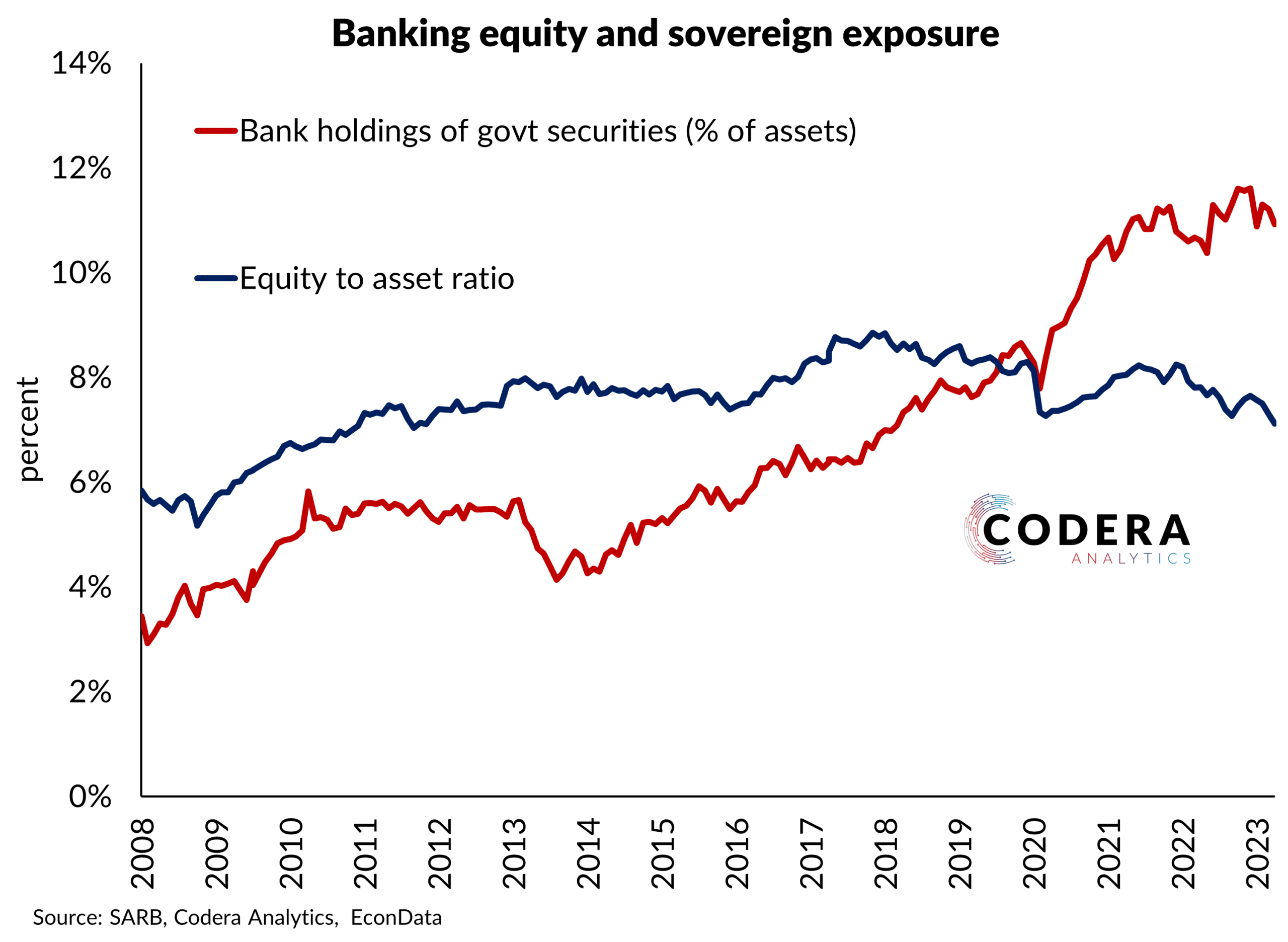

A high equity to assets ratio tends to be seen as an indicator of improved financial soundness of banks, while a higher ratio of sovereign assets on the balance sheets of banks indicates greater banking sector exposure to sovereign risk. South African bank equity rose to meet higher banking regulation capital requirements between 2013 and 2019. We observe that since then, the bank equity to asset ratio of the banking sector has declined. The proportion of government securities on bank balance sheets has risen further since 2019, implying increased sensitivity of bank balance sheets to sovereign creditworthiness and money market developments. This also raises questions around the availability of credit for productive investment and the effective use of credit by the government.