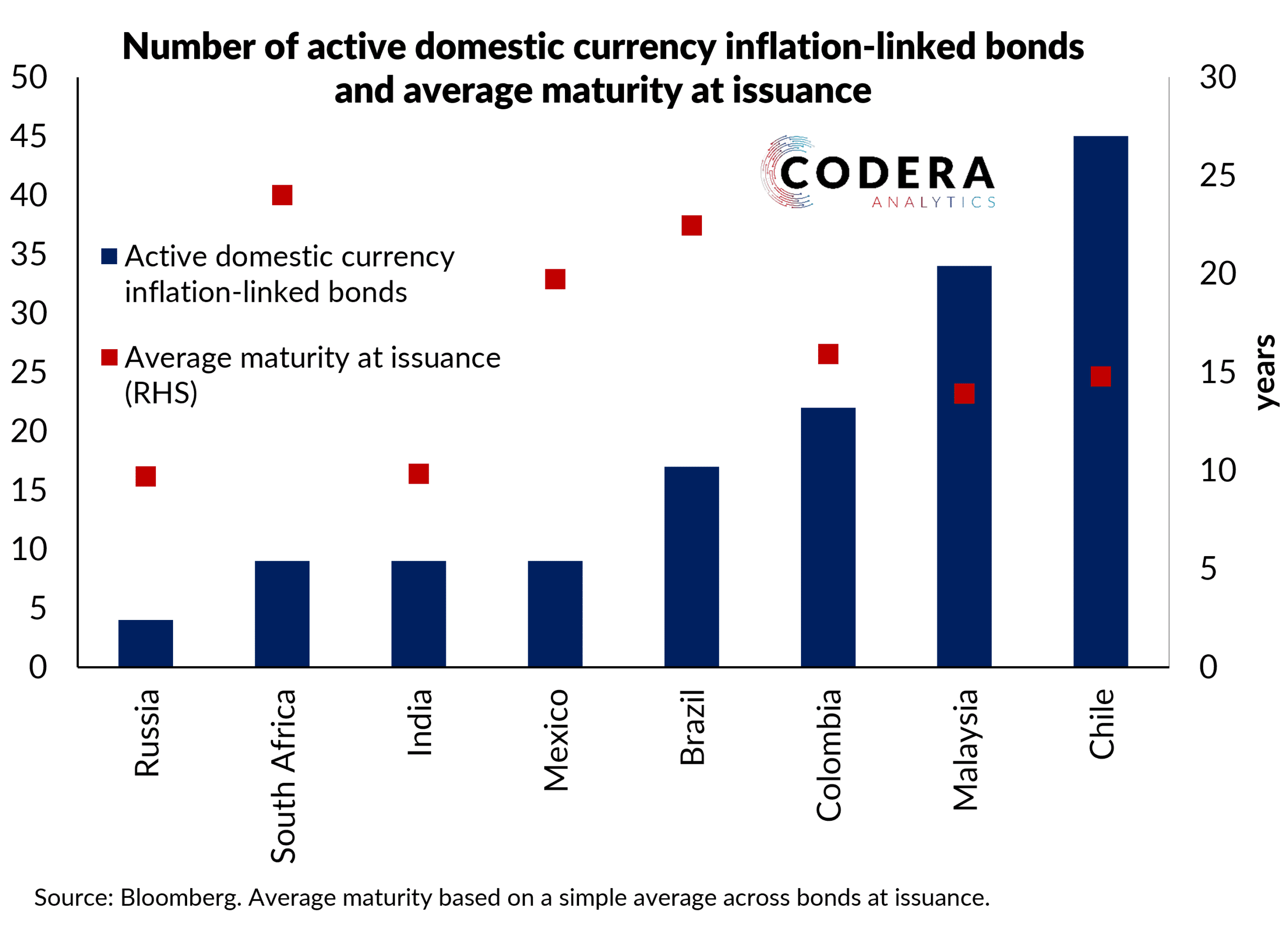

South Africa has issued a relatively small number of domestic currency government bonds (only 12 are currently active) at a relatively long maturities compared with other major emerging markets (a simple average of 24 years compared to an average across the group considered of around 15 years) . The number of linkers issued has also been lower, though, like other EMEs that issue linkers, their average maturity has been similar to that of nominal bonds.

Issuing bonds at long maturities is meant to reduce rollover risk. In South Africa’s case, this policy has, however, likely meant higher funding costs than could have been obtained by funding at shorter maturities during a time of historically low short-term interest rates. As I have previously shown, cross-country data does not suggest that countries with longer funding structures had systematically lower overall risk premia over the last decade or so. As we argued in an earlier paper, limited sovereign issuance at short and medium term maturities may also be one explanation for South Africa’s high long term sovereign interest rates.

Footnote

Argentina is not plotted as its issuance has been focused on foreign currency denominated bonds.