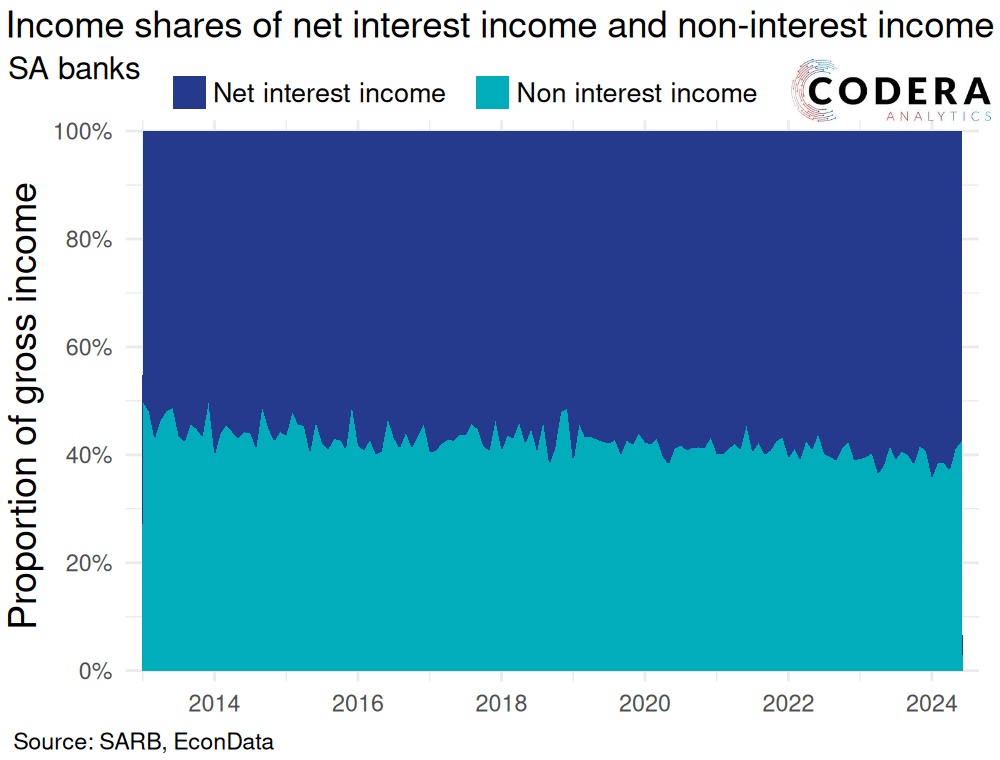

South Africa’s major banks stand out globally among large banks in terms of their return on equity ratios. Today’s post looks at the composition of banking sector income in SA. Net interest income represents just under 60% of banking income, having risen slightly during the recent monetary policy tightening cycle. South Africa’s large banks generally have interest income that rises from higher policy rates and slower-than-expected repricing of deposits, which helps to raise their interest income during periods of higher policy rates (see here, here and here). Non-interest income has been under pressure from a decline in average bank sector fees on payments.

Compiled by Aidan Horn