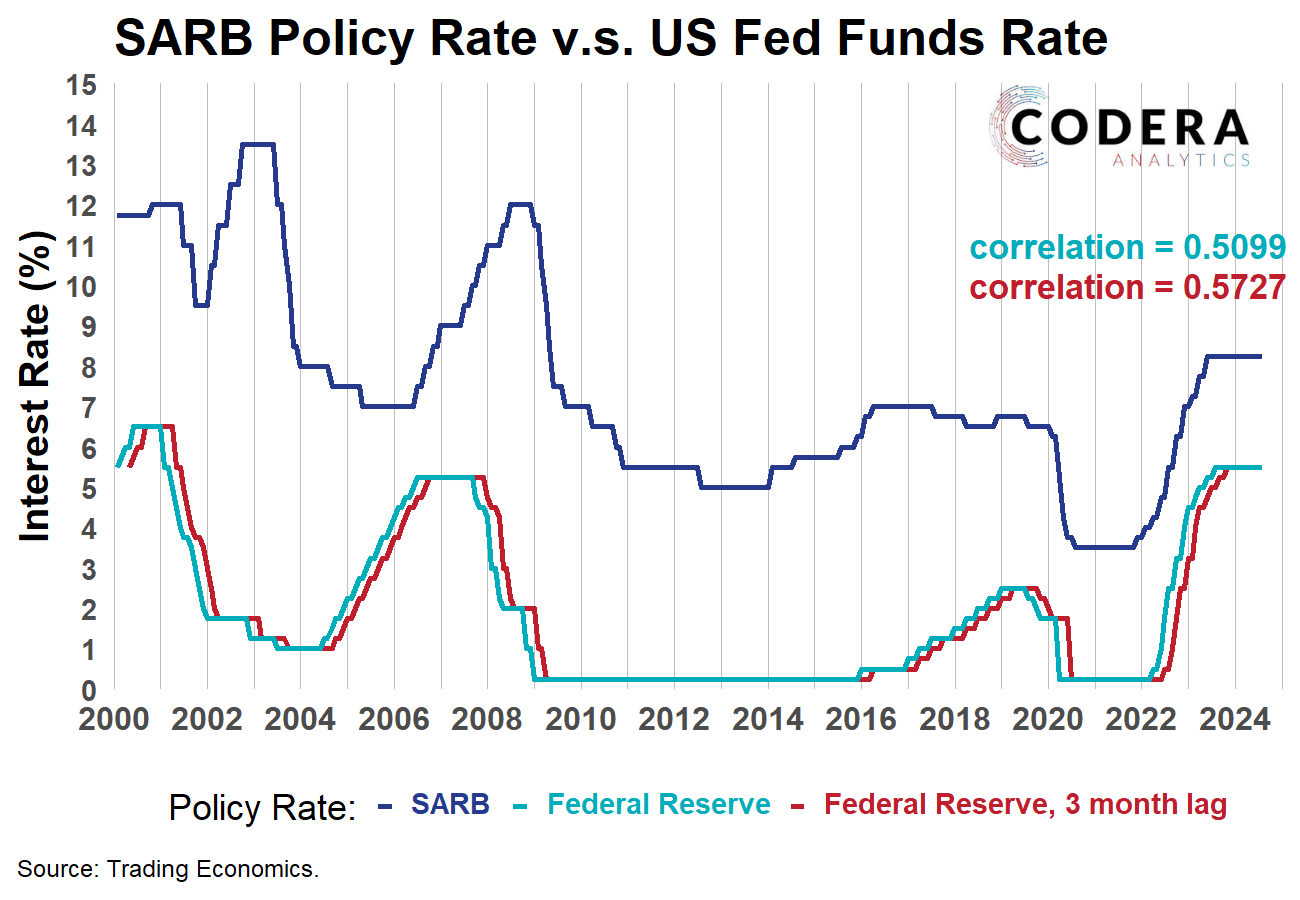

Every time the Federal Reserve changes its policy rate economists speculate about whether the South African Reserve Bank (SARB) will follow suit. Today’s post shows that the coincidence between US and SA monetary policy has varied a lot over time. The Fed tightened earlier in the lead up to the Global Financial Crisis of 2008 and cut earlier immediately following it. Between 2010 and the 2020 COVID-19 pandemic the correlation between US and SA monetary policy was weaker, with the effects of South African idiosyncratic events like the 2016 drought clearly visible, for example. SARB’s monetary policy cycles appear to have become more coincident with the US Fed’s since 2020’s COVID-19 pandemic. Since 2000, the correlation between the 3-month lagged fed funds rate and the repo rate is 0.57, suggesting the SARB has tended to follow US monetary policy eventually. Interestingly, the correlation is higher at longer lags, although this should be interpreted with caution as some policy cycles have lasted less than a year. Ultimately, whether the SARB will follow the Fed if it cuts later this month depends on how correlated South Africa’s economic cycle and capacity pressures are with those of the US and the extent to which relative interest rates and currency movements synchronize underlying inflation pressure. It is also worth noting that the Fed’s mandate includes supporting maximum employment, which makes US monetary policy more reactive to labour market developments. In the US, demand pressures have been softening, although nowcasts suggest their output gap remains positive and above 3%. SARB estimates that the output gap remains slightly negative here and its QPM model assumes slightly more than 50 basis points of cuts in 2024 and one more 25 basis point cut in 2025 would be consistent with keeping inflation at the midpoint of our inflation target over the medium term.

Compiled by Oliver Guest