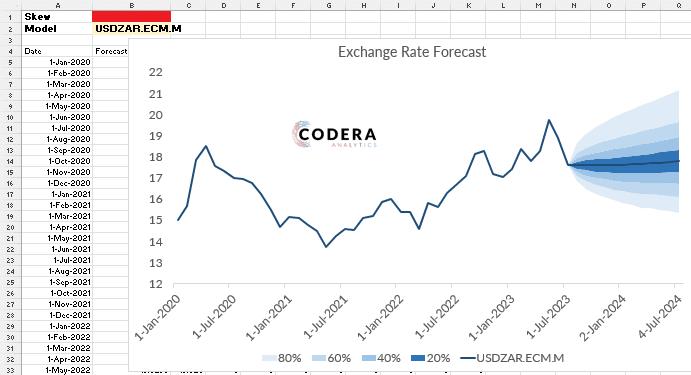

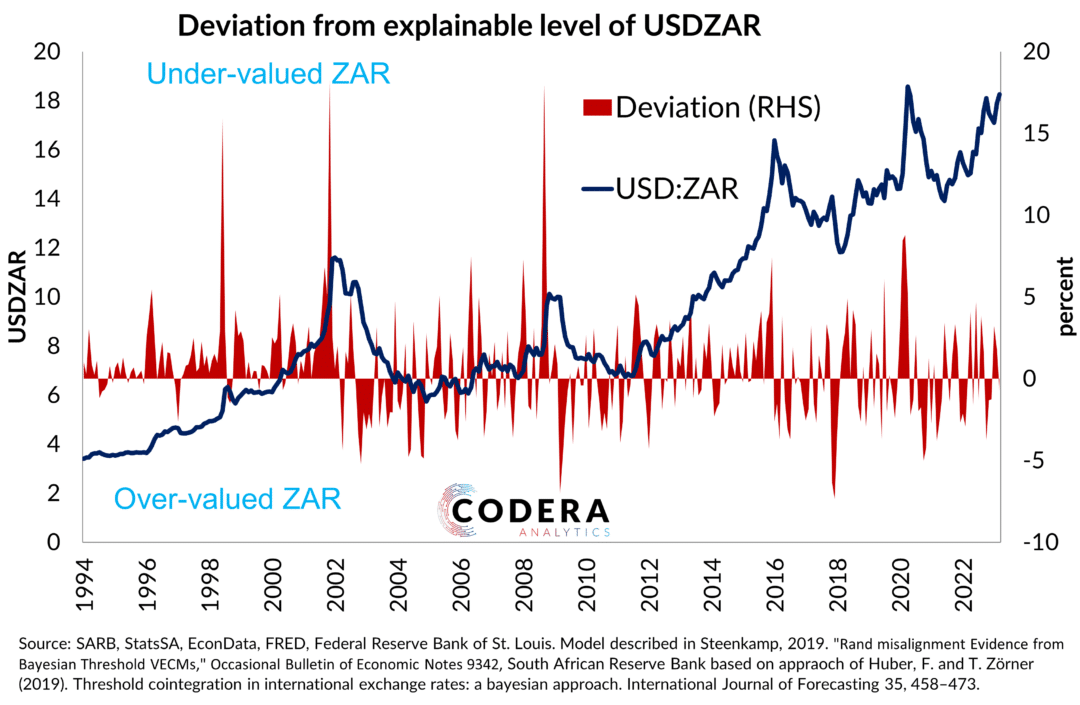

We are planning to make our forecasts available via our EconData platform, allowing users to access them in R, through the webportal or in Excel. In Excel, for example, users can select any model from Codera’s model suite and then assess the probability that the rand could be above or below user-defined threshold levels, as well as impose judgements about the balance of risk around the value of the rand. As an example, our fair value model (ECM below) has fairly stable probabilities for the USDZAR outlook over the long term. This is because fair value models of this type tend to suggest that the exchange rate can take years to correct misalignments from what inflation and interest differentials would imply.

Users can also add judgements about the balance of risks around forecasts directly in Excel. For example, if a user wanted to use information from the options market to measure market expectations of the risk profile of the currency they could tune the ‘Skew’ parameter in our tool (as in the red tab below) to assess risk that the the currency could appreciate or depreciate. Codera will be launching an FX forecasting service, contact us if you are interested in subscribing.