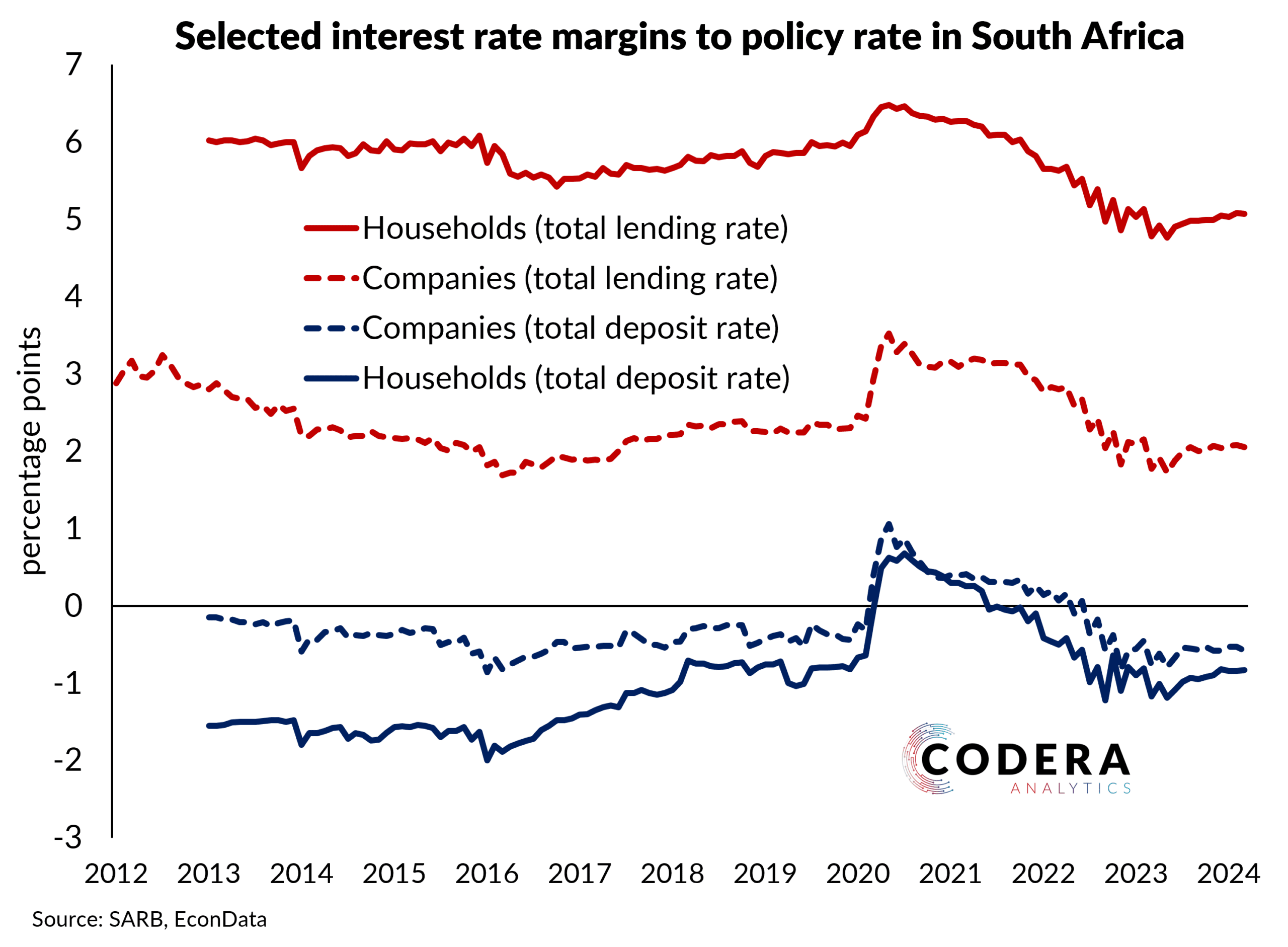

The margins between bank lending rates to households and companies and the policy rate are below their averages since 2013, while deposit rate margins are closer to their historical averages. This is suggestive of increased competitive pressures in bank lending.

South African banks are highly dependent on deposits as a form of bank funding, which provides relatively cheap funding. with deposit rates below the policy rate. This is in sharp contrast advanced economies such as Australia and New Zealand, where deposit rates have tended to be above reference rates, on average. As we argued here, slow, and incomplete pass-through of policy changes to deposit rates is likely to have distributional consequences, as poorer individuals may hold proportionately larger balances in cheque accounts than wealthier individuals.

The full South African Reserve Bank Quarterly Bulletin (over 4500 economic and financial concepts) is now available on our EconData platform. We at Codera are passionate about democratising data and have made this dataset available for free for non-commercial use. Try the platform for free at https://econdata.co.za/ and contact us if you are interested in a commercial subscription.

Footnote

For more about policy rate passthrough in SA, see this earlier post and a back-of-the-envelope assessment of deposit and loan betas for large banks in SA, this post.