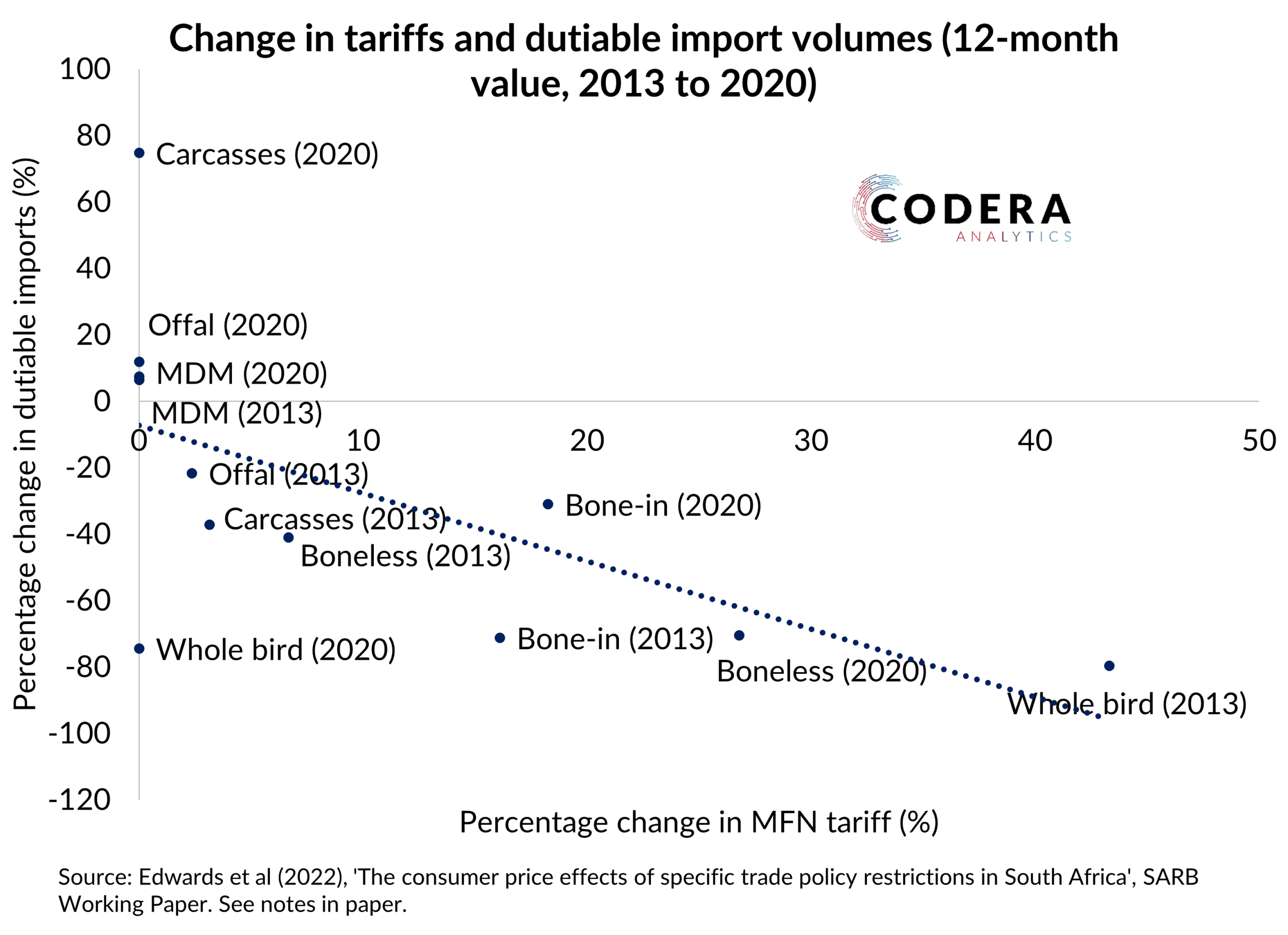

While the SA Poultry Association has argued that anti-dumping duties on chicken have not raised domestic prices, a recent SARB working paper finds that trade protection has indeed pushed up prices. The authors show that the average applied tariff on frozen boneless and bone-in chicken increased from about 9% in 2012 to 53% in 2021. They estimate that almost half of the applied tariff increases have been passed on to consumers prices for frozen chicken, with consumer prices 16% higher than had the tariff increases, safeguards and anti-dumping duties not been imposed. The paper demonstrates how (in the case of tariffs on frozen chicken) the costs of trade protection fall on low-income consumers.

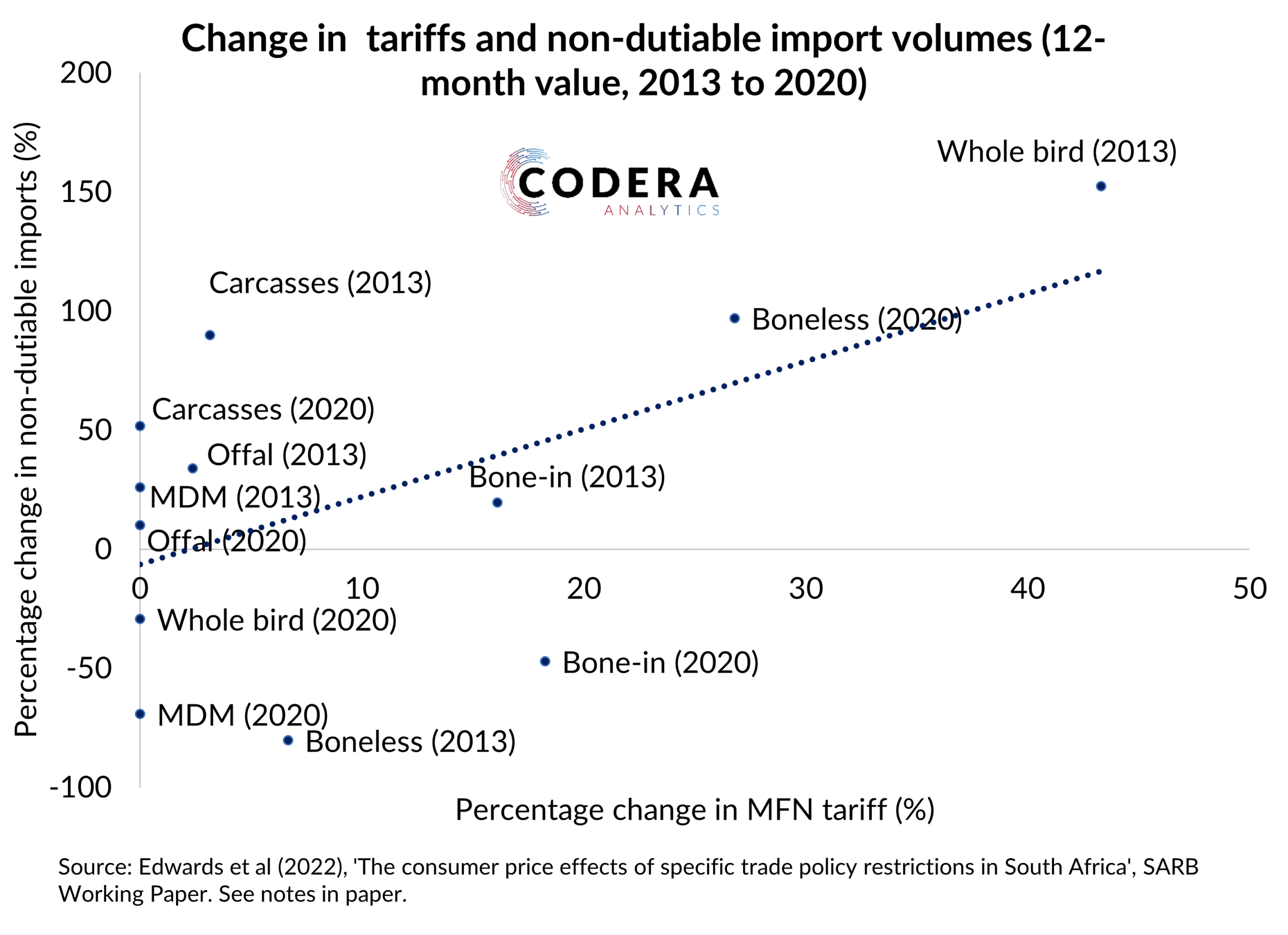

The paper also shows that imports from producers affected by tariff increases have declined (such as frozen imports from Brazil), while imports from producers not affected by tariff increases (mainly EU producers) have risen (see charts below).

There results highlight an important nuance that is usually missed in debates around whether a domestic industry should be afforded protection from foreign competition. Should a domestic industry be unable to increase production to replace the imports from foreign producers subject to tariff increases, importers just source imports from markets not subject to tariff increases. This means that trade protection might end up benefiting foreign exporters and not domestic producers. This is what we have observed in South Africa across a range of industries: electricity availability constraints, higher relative inflation and infrastructure problems have constrained the ability of domestic producers to increase supply (see also here for a example from the mining industry). This research therefore has important implications for how one should think about competition and trade policy in South Africa.